The Pacific Island countries (PICs) are known for their abundance of natural resources and unique geographical location, offering vast potential growth for small and medium-sized enterprises (SMEs) in industries such as agriculture, timber, fisheries, the digital economy, and green energy, many of which align with China’s ongoing Belt and Road Initiative (BRI).

During my three years at Pacific Trade Invest (PTI) China, I learned to appreciate the way Chinese do business and their outlook on business growth and view of the world. Chinese investors are always looking for viable business opportunities to expand and grow in locations along the BRI and will not shy away from asking “What is the return on my investment in the Pacific Islands?”

One of the challenges facing Chinese investors when looking to the Pacific Islands is a lack of scientific analysis on investment projects to determine investment scale, prospects and risks in the Pacific, which provides investors a basis for investment decisions. On the market front, while we have an understanding of the way Chinese do business, it was important for us to mobilise and focus on a target group of Chinese investors and gauge their interest.

Earlier this year, we commissioned an investment market research study with the aim of better understanding Chinese investors’ investment appetite, industries of interest, and their overall overseas investments, specifically targeting PICs and related industries. The study would eventually provide feasible investment models to potential investors and offer an investment promotional program for Chinese companies to invest in industries of interest in the PICs. We also engaged with the of some of our PICs, including Fiji, Papua New Guinea, Vanuatu and Solomon Islands, to discuss their investment research and promotion plans. Extensive desk research was undertaken on new and revised policies, regulations, and incentive measures for foreign direct investment.

The first phase of the research is now complete, with over 30 Chinese companies surveyed comprising potential Chinese investor companies, and groups/consortiums in industries such as

AT PTI China, our role in promoting and facilitating investment opportunities is to ensure we have an investment climate that attracts investors, and that investment policies are in place to create market attractiveness. It is not news that China is a huge, competitive and complex market, and while our in-market investment promotional campaign is to promote our uniqueness and potential as a region for business, we must also have an investment environment that is conducive to, and provides ease of, doing business for our investors.

In April this year, after three long years of COVID restrictions on travel, I visited Fiji and the Solomon Islands. I met with 25 SMEs and related government ministries in both countries. In these meetings, I was encouraged to see reforms in investment policies, to attract desirable investments into the countries and streamline processes and registrations. While such structural reforms streamline government and legislative processes, and provide attractiveness to potential investors, there is still a need to further assess the feasibility and readiness of investment projects in some of our countries.

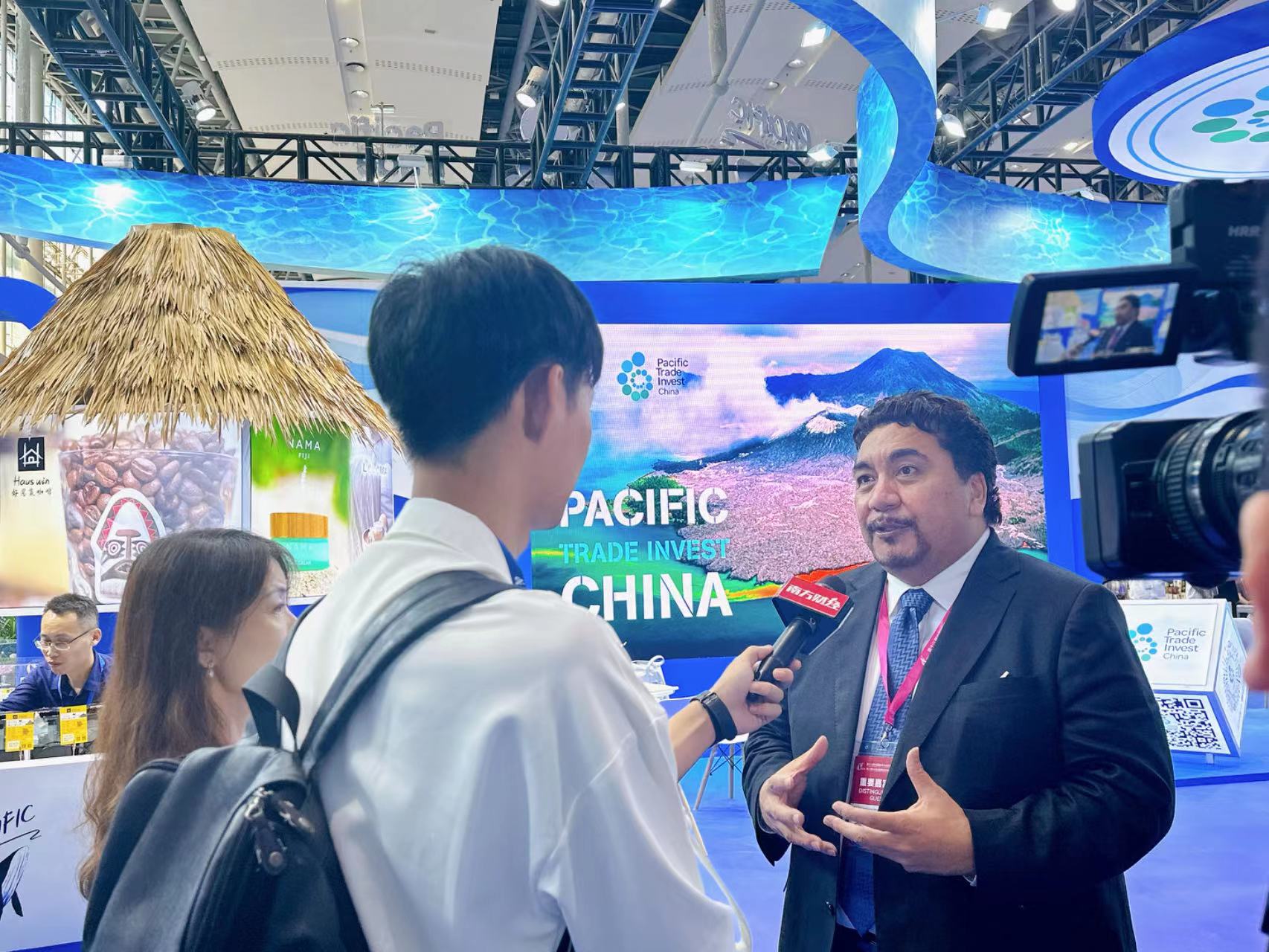

At PTI China, we have continued our marketing and promotional efforts to ensure the Pacific remains top of mind for both buyers and investors. Recently, I was in Guangdong Province South of China to participate in our first China International Small and Medium Enterprises Fair, where we showcased a range of high-end products from PICs, while raising our investment profile. During a meeting with the local Commerce Ministry, I learned that Guangdong’s 2022 annual GDP reached a remarkable CNY12 trillion, with Guangdong SMEs contributing an impressive CNY8 trillion to economic growth. This rapid growth of Chinese SMEs in Guangdong serves as a reminder there are opportunities to capitalise on this growth, to attract top-tier investors in such an attractive business environment. We just need to create viable and investable opportunities in the Pacific Islands, and ensure the investment pipeline is clear and attractive to investors.